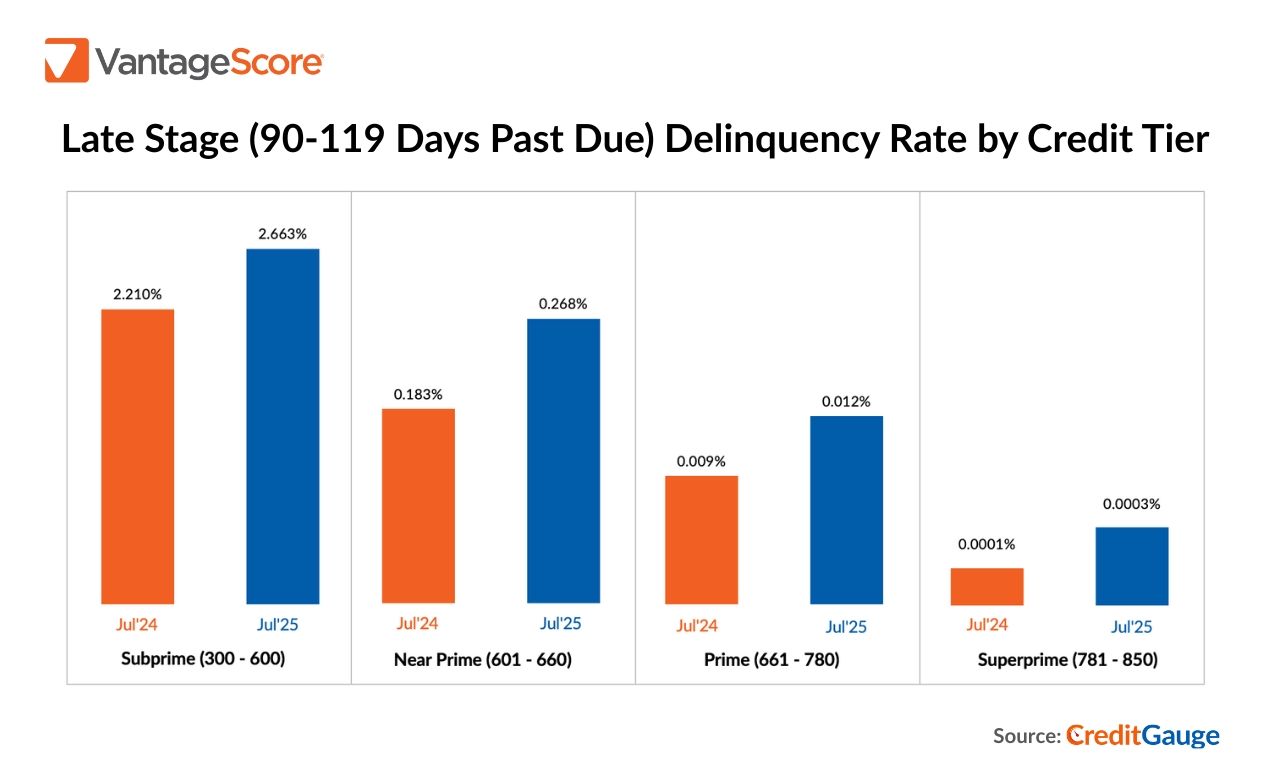

In relative terms the sharpest increase in delinquencies was seen in Superprime and Prime customers who are typically considered the most financially secure,

said Dr. Rikard Bandebo, Chief Strategist and Chief Economist at VantageScore, regarding VantageScore”s July 2025 CreditGauge™ data.

Reuters reports that U.S. consumers with the highest credit scores are starting to fall behind in debt repayments in a sign that Americans’ financial health may be deteriorating more broadly. VantageScore’s July 2025 CreditGauge™ data shows that late repayments over 90 days were up 109% year-over-year in the VantageScore Superprime segment, while the Prime segment posted a 47% increase year-over-year.

There has also been an uptick in late-stage delinquencies in Auto Loans and Mortgages, as consumers grapple with budget strains,” added Dr. Bandebo. “Defaults on secured loans, such as mortgages, typically happen only when the pressure on finances is too much for the consumer to manage.

Early-stage defaults, comprising late repayments between 30 days and 59 days, increased at the fastest pace in Auto Loans and Mortgages. Meanwhile, new originations for Auto Loans and Mortgages also fell in July.

Check out the Reuters article here: https://www.reuters.com/business/finance/us-consumers-with-prime-credit-are-starting-slip-payments-2025-08-25.

Read more on VantageScore’s July 2025 CreditGauge™ on our website: https://vantagescore.com/resources/knowledge-center/press_releases/vantagescore-creditgauge-july-2025-late-stage-credit-delinquencies-increase-across-all-vantagescore-credit-tiers.