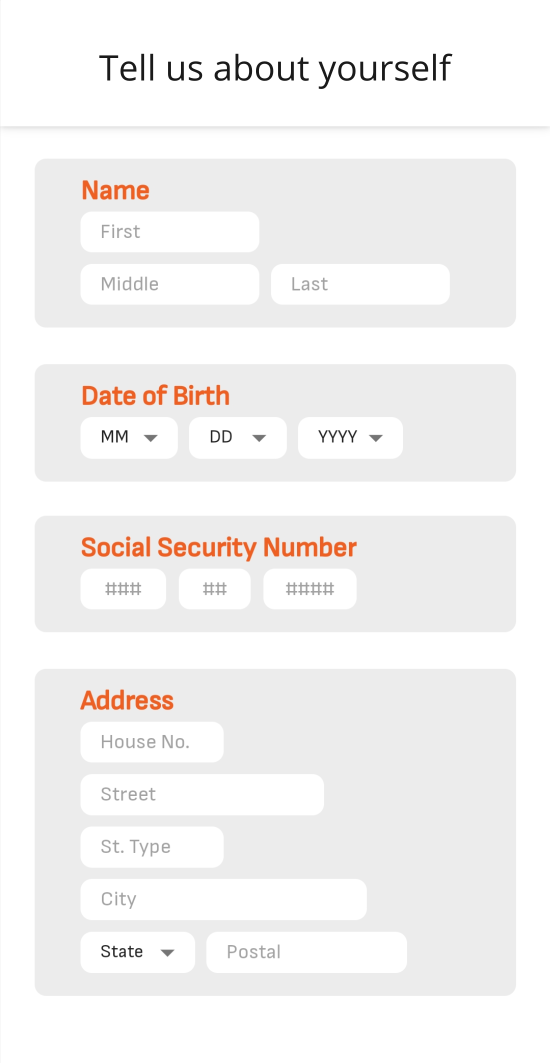

Let us know who you are

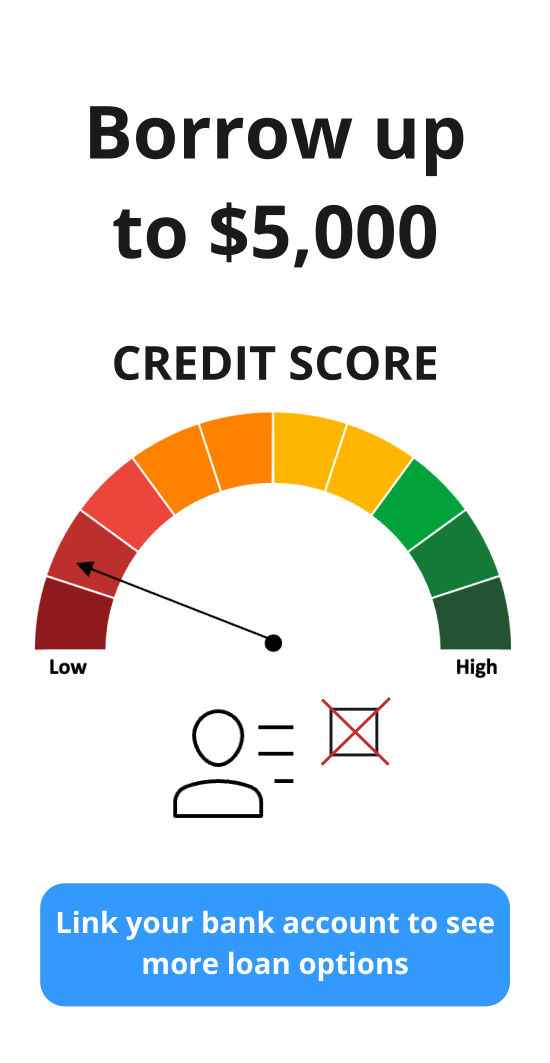

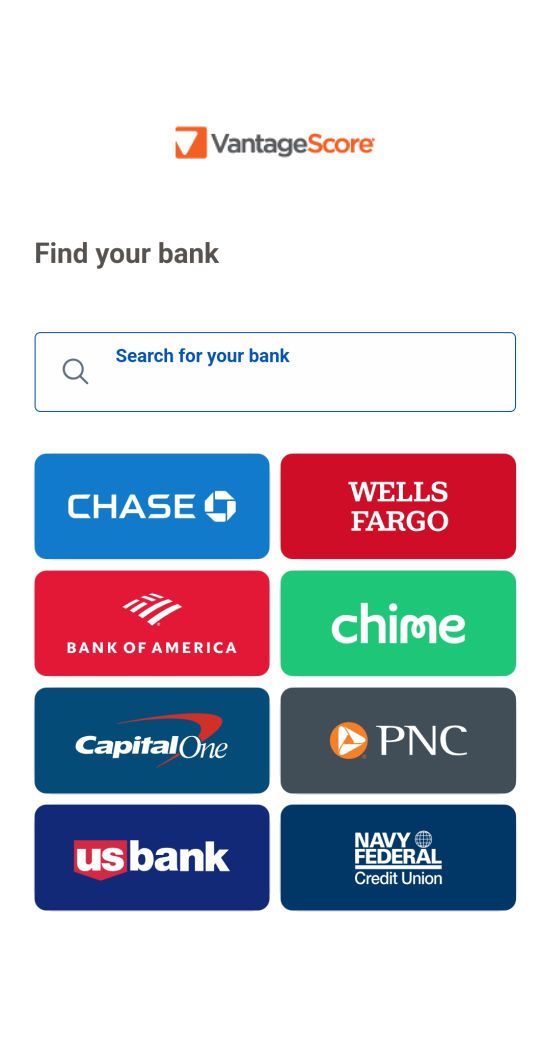

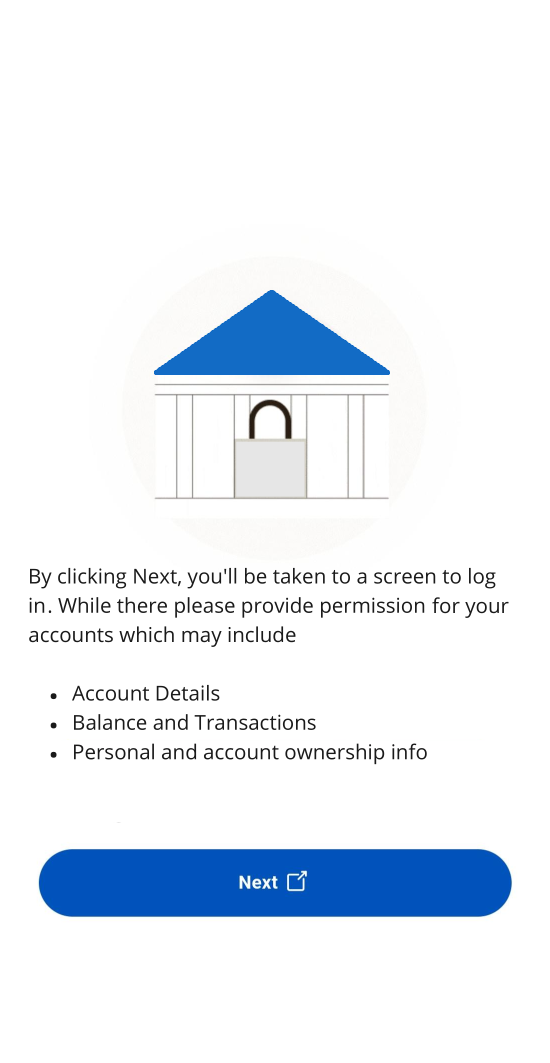

VantageScore 4plus is built using VantageScore's pioneering and patented technology, featuring all the benefits of the widely adopted VantageScore 4.0 credit scoring model, and uniquely combining alternative open banking data to provide an actionable, real-time adjusted credit score that is FCRA compliant.

Performance

Provides up to 10% predictive lift to the industry leading VantageScore 4.0 credit score, which has up to an 8% lift over conventional scoring models.

Financial Inclusion

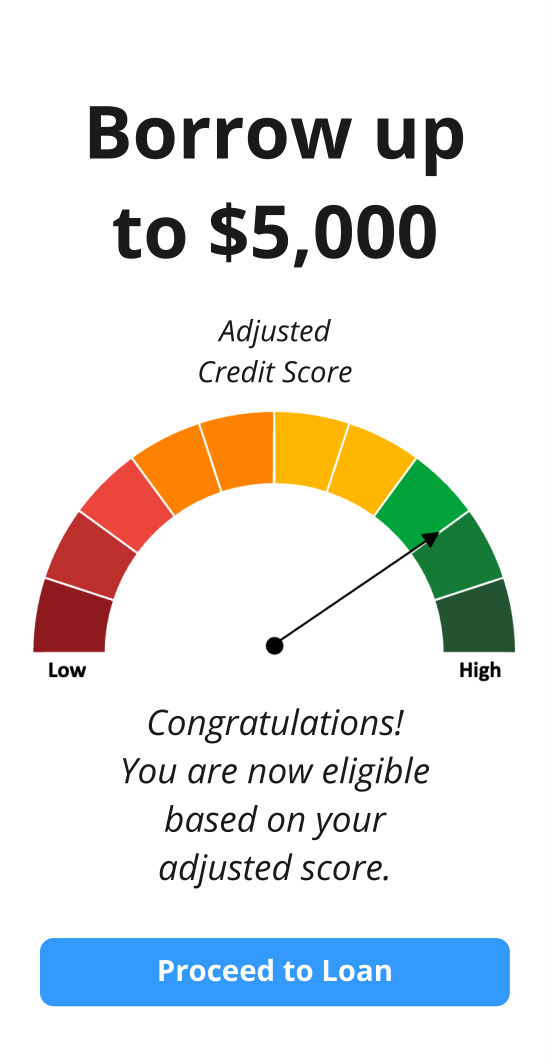

Consumers can share a more complete view of their financial picture with lenders, increasing their chances of being approved for mainstream loan products like credit cards, personal loans, and auto loans.

Lender Control

The lender initiates the process and decides when to present VantageScore 4plus™ offer to consumers.

Real-time Lending

VantageScore 4plus provides a credit score adjustment within seconds helping lenders make real-time lending decisions.

FCRA Compliant

VantageScore 4plus has an FCRA compliant process for the bank account data, which allow adjusted scores to go up and down, including transparent reason coding for consumer disclosures.

Lenders and fintechs can work directly with VantageScore to pilot and validate the predictive performance and game-changing financial inclusion impact of VantageScore 4plus. Through a process that can be customized to lenders' underwriting process, lenders can gain a clear understanding of how many more consumers they could approve using this enhanced credit-scoring model without adjusting their own credit policies and credit score cutoffs.

Request a Demo

Using positive cashflow data in underwriting may improve access to credit for populations with historically low credit scores. The CFPB is undertaking rulemaking to help consumers share such data with lenders willing to use it in their underwriting.

CFPB, July 2023

At a time when delinquencies are reaching the highest levels we have seen in recent history, the need for a credit score that gives deeper insights into a member's ability to pay back is critical. Through our testing of VantageScore 4plus we've seen its ability to more accurately represent a consumer's creditworthiness, helping Patelco increase its ability to lend to more members during these uncertain economic times.

Yazel Pardo, Head of Credit Risk at Patelco Credit Union

The use of consumer permissioned bank account data is a huge step forward in creating a credit score that is more predictive and reflective of a consumer's full financial profile, helping them build their credit and gain access to mainstream financial products. We applaud VantageScore's innovation and encourage greater usage of VantageScore 4plus among lenders.

Dara Duguay, CEO of Credit Builders Alliance

First-moving adopters including banks, credit unions and fintechs are already piloting VantageScore 4plus. As the financial services industry "leans in" to open banking concepts, consumer-permissioned data to drive credit decisions will soon become standardized.

![Consumer is reassessed based on the VantageScore 4<sup class="pl-[2px] italic leading-none">plus</sup><sup class="font-thin">™</sup> adjusted score](/images/carousel/8.png)