Mortgage growth is “occurring at a faster pace than for delinquencies involving other types of consumer credit, including auto loans, credit cards, and personal loans,” said Atif Mirza, Head of Credit Insights at VantageScore.

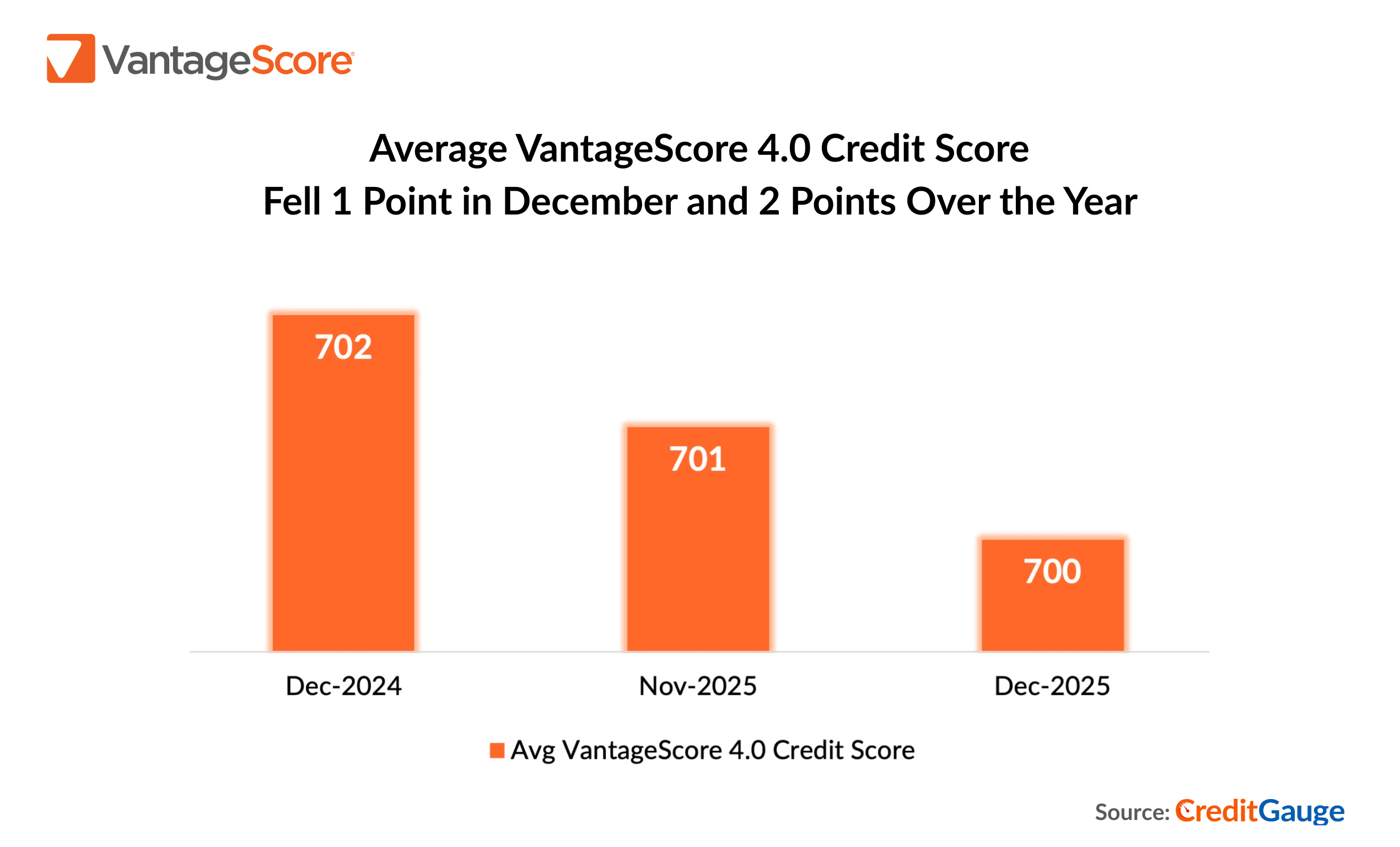

VantageScore’s December 2025 CreditGauge analysis revealed that late-stage mortgage delinquencies—defined as payments at least 90 days past due—increased 18.6% in December compared with a year earlier. The share of mortgages in that stage of nonpayment increased to 0.2%, up from just under 0.17% in December 2024.

Mortgage delinquencies “signal affordability-driven strain,” according to Mirza, who says elevated interest rates and housing prices are the two biggest drivers of that affordability pressure. Consumers’ monthly payments have also been impacted by rising property taxes, homeowners’ insurance, fees, and more – making it hard for people to keep up when their incomes have not increased to match their financial obligations.

Check out the latest delinquency and credit trends on VantageScore’s CreditGauge tool.

Read the full Yahoo! Finance article here.