Late-stage mortgage delinquencies rose 18.6%, according to a recent VantageScore CreditGauge analysis. Housing affordability challenges are weighing not only on would-be buyers but also on a growing share of existing homeowners.

While the share of mortgages at that stage of nonpayment remains small at about 0.2% — up from just under 0.17% in December 2024 — the growth is occurring at a faster pace than for delinquencies involving other types of consumer credit, including auto loans, credit cards and personal loans, said Rikard Bandebo, Chief Strategy Officer and Chief Economist at VantageScore.

Compared with the nonpayment levels seen during the financial crisis in 2008 to 2010, “this is a considerably lower delinquency rate,” Bandebo said. “But it’s still a concerning sign that [delinquencies] are increasing.”

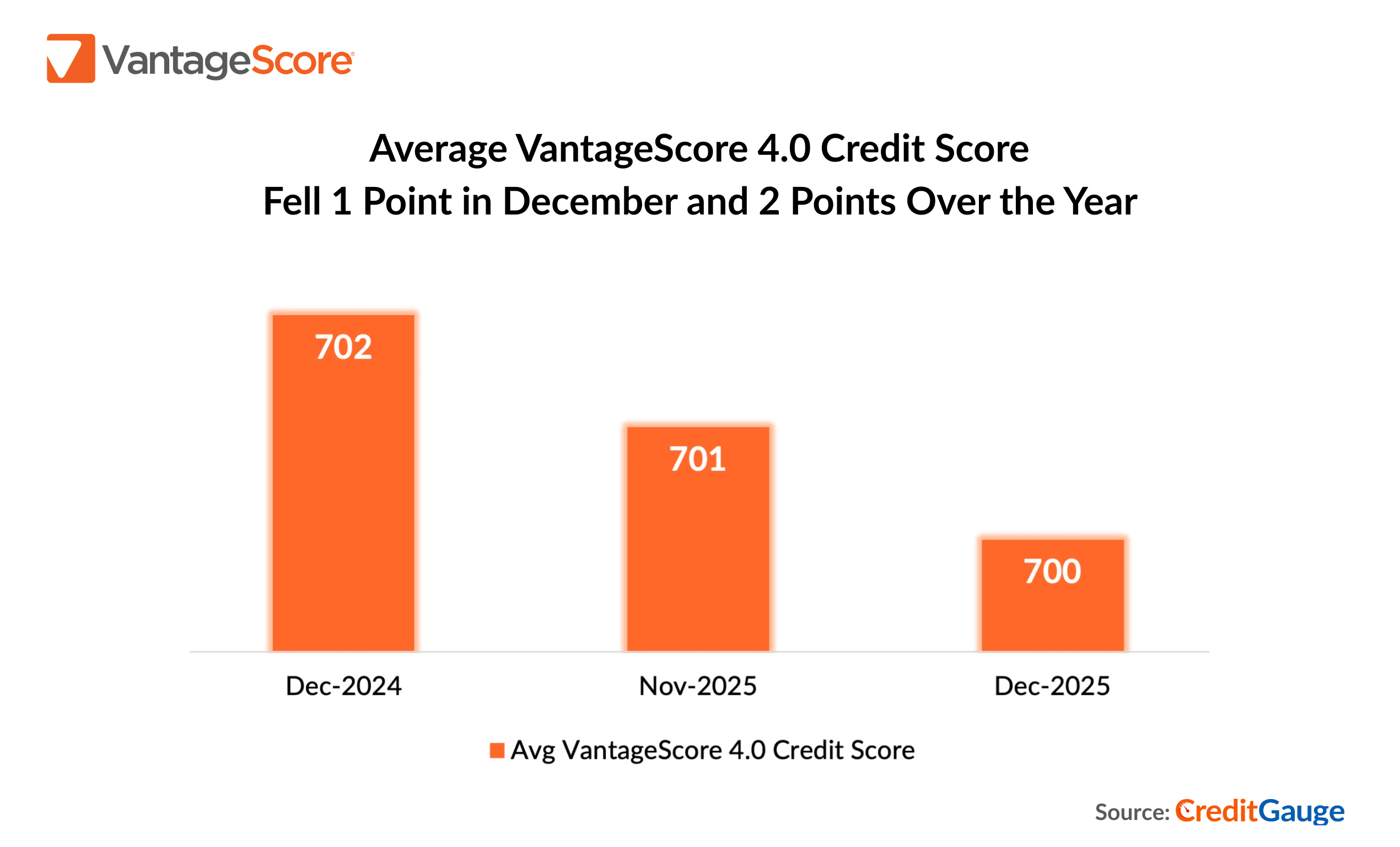

This recent rise in delinquencies helped push the average VantageScore credit score down to 700 in December, a one-point decline from November and a two-point drop from a year earlier.

Check out the latest delinquency and credit trends on VantageScore’s CreditGauge tool.

Read the full CNBC article here.