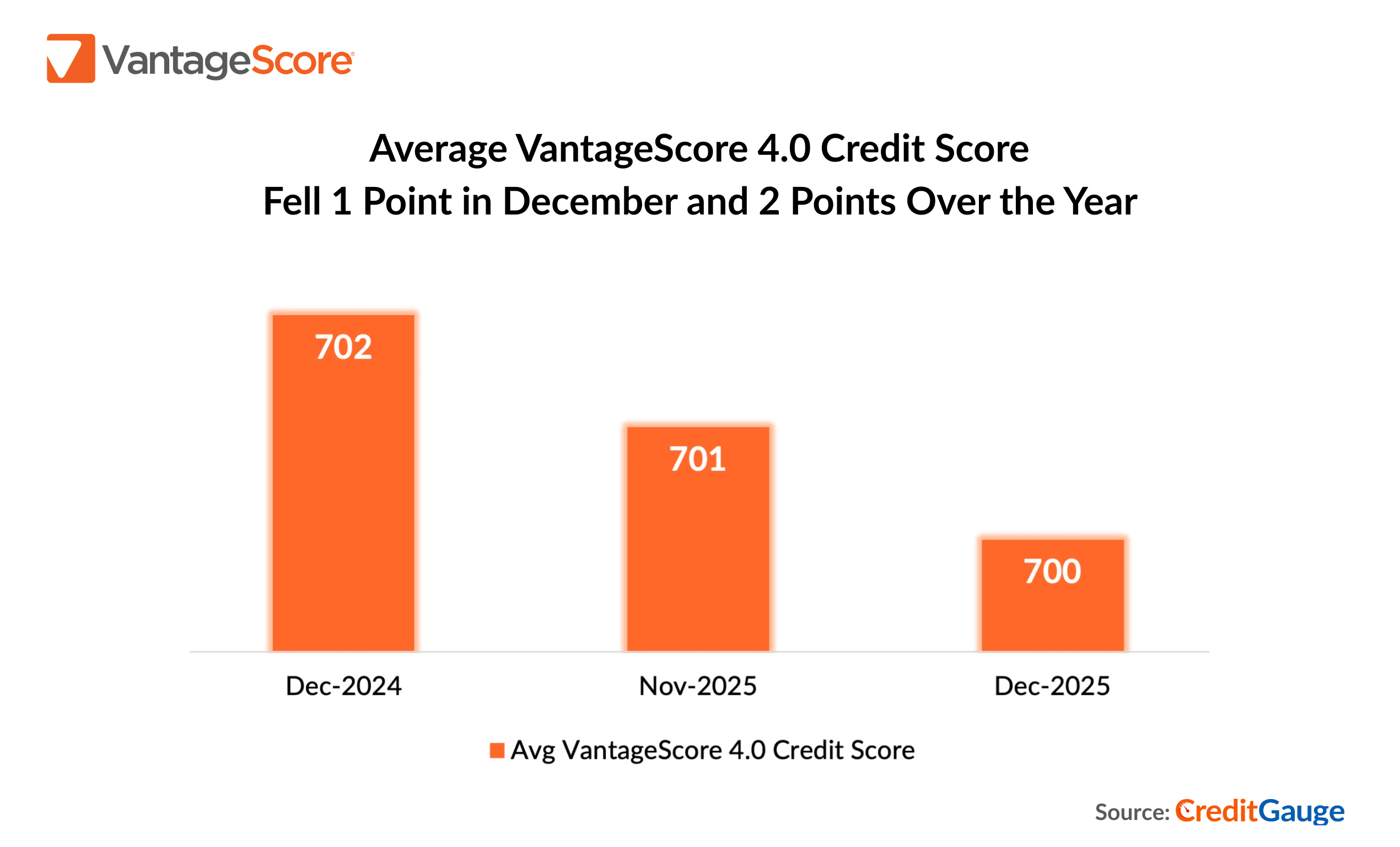

By the end of 2025, consumer credit conditions showed signs of softening, led by rising delinquency pressure and a modest decline in credit scores, according to the latest edition of CreditGauge™ from VantageScore. Overall credit delinquencies increased across all late payment stages, with late-stage mortgage delinquencies rising sharply year-over-year and increasing consistently across mid-stage and riskier credit tiers, signaling affordability-driven strain. The average VantageScore 4.0 credit score declined by one point to 700.

Consumers in the 2025 holiday season showed some softening in credit health, with the average VantageScore 4.0 credit score falling to 700, an average last seen in early 2023,” said Susan Fahy, EVP and Chief Digital, Data and Technology Officer at VantageScore. “Higher mortgage and auto loan delinquencies reflect the effects of elevated interest rates and prices in today’s housing and auto markets.

Watch CreditGauge LIVE for additional key insights from the December 2025 edition of CreditGauge that include:

AVERAGE VANTAGESCORE DECLINES ONE POINT IN DECEMBER AND TWO POINTS FOR THE YEAR: In December 2025, the average VantageScore credit score declined to 700, a return to early 2023 levels. This one-point month-over-month decline and two-point year-over-year decline in the average credit score reflect modest softening in consumer credit profiles, but not broad-based consumer stress.

NUMBER OF VANTAGESCORE SUBPRIME BORROWERS GROWS AS NUMBER OF VANTAGESCORE PRIME BORROWERS CONTRACTS: From December 2023 to December 2025, the share of consumers in the VantageScore Subprime credit tier increased from 18.5% to 19.0%, while the VantageScore Nearprime segment edged up from 17.6% to 17.9%. Over the same period, the VantageScore Prime tier declined by 1.1%, indicating a gradual migration of consumers to lower credit tiers, reflecting pressure from ongoing affordability constraints.

OVERALL CREDIT DELINQUENCIES TICK HIGHER ACROSS ALL LATE PAYMENT STAGES: In December 2025, overall delinquency rates edged up on both a month-over-month and year-over-year basis across all categories. Late-stage delinquencies saw the highest month-over-month and year-over-year increases, rising to 0.27% from 0.24% and 0.19%, respectively. Early- and mid-stage delinquencies also ticked up on both a monthly and an annual basis. These trends suggest emerging repayment strain among a subset of borrowers at year-end amid persistently elevated borrowing costs.

Follow VantageScore on LinkedIn and YouTube to watch CreditGauge LIVE, a monthly video series featuring our latest insights on consumer credit data and analysis.

CreditGauge is a monthly analysis highlighting the overall health of U.S. consumer credit. To download this month’s full CreditGauge report, visit the VantageScore website.