Susan Fahy, EVP and Chief Digital Officer at VantageScore, recently joined host “Money Life” with Chuck Jaffe to share VantageScore’s February 2025 CreditGauge™ insights and the credit health of the U.S. consumer.

Susan explained the impact of the recent resumption of student loan credit reporting on consumer credit files, as outlined in VantageScore’s quantitative student loan analysis.

“Overall late-stage delinquencies have spiked month-over-month from January to February. The primary reason is the resumption of student loan payments. We estimate that there are approximately 22 million consumers who are not in deferment on their student loans, and nearly 10 million of them are behind.”

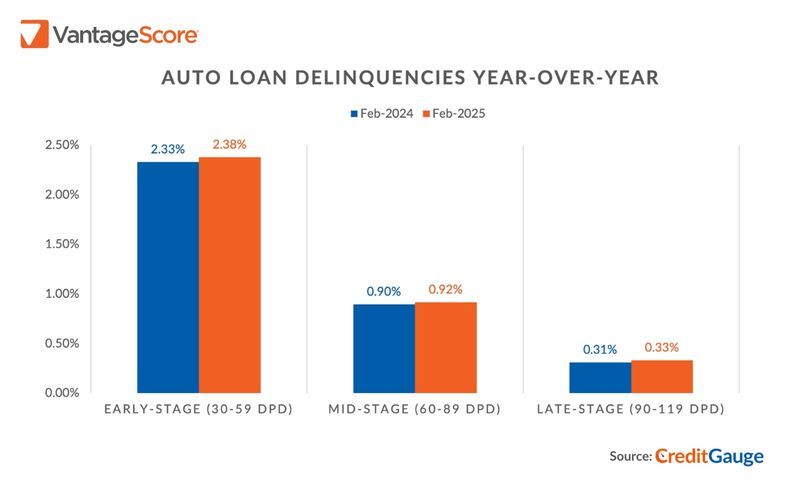

Susan also elaborated on how auto loan delinquencies are contributing to the decline in the average VantageScore credit score.

“The other reason is in the auto loan category, where delinquencies are up across all delinquency categories, both year-over-year and compared to pre-pandemic levels. The combination of student loan resumption and auto loans are starting to see an impact on the average VantageScore credit score.”

Link to podcast: https://moneylifeshow.libsyn.com/vineyard-globals-samuelson-says-technicals-show-a-market-on-thin-ice