A growing number of Americans are falling behind on car loan payments as loan sizes and student debt repayment pressures rise.

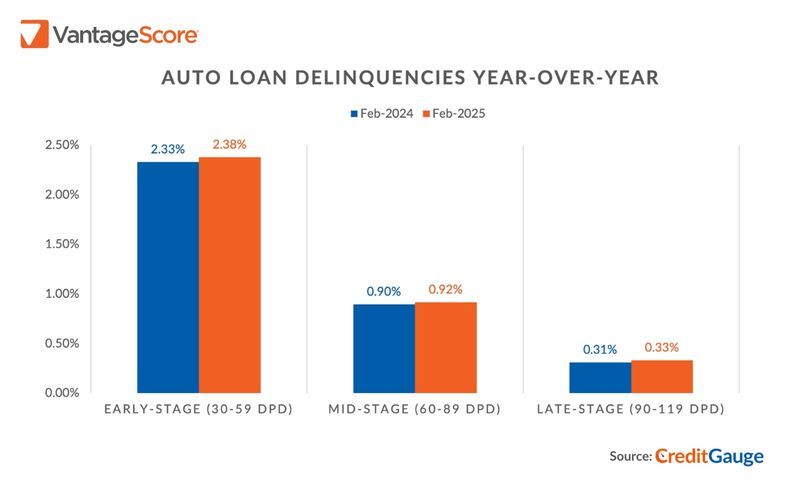

VantageScore’s February 2025 CreditGauge analysis showed that auto loan credit delinquencies climbed in February from a year ago. Delinquencies were above pre- pandemic levels across all days-past-due categories tracked, as average loan balances swelled by more than $400 from a year ago.

This shift marked a sharp rise in late-stage delinquencies, or those that are over 90 days past due, across different types of loans, including student loans. Overall, late- stage delinquencies were up 25 basis points month-over-month to 0.45%, driven largely by student loan credit reporting.

As late-stage delinquencies rose, the average VantageScore credit score dropped to 701, after remaining at 702 for 11 months. Susan Fahy, EVP and Chief Digital Officer at VantageScore, noted:

It’s unusual to see a [score] decline of this size, and we attribute the change to the increased demands of car loan balances and student debt repayment.