The FHFA was right to open the door to VantageScore. The time for credit-score competition has come.

– Silvio Tavares, VantageScore President and CEO

You might have recently seen headlines about the year’s most consequential announcement: the Federal Housing Finance Agency (FHFA) now requires that VantageScore 4.0 credit scores be accepted for mortgages issued by Fannie Mae and Freddie Mac, effective immediately.

What does the acceptance of VantageScore 4.0 credit scores for mortgages mean for homebuyers?

Outdated models in housing finance often exclude millions of creditworthy, underserved borrowers. Recent VantageScore research finds that many consumers characterized as “dormant” by these antiquated models were, in fact, simply infrequent or rare users of credit. One example might be a consumer who prefers to pay in cash but repaid an auto loan in the past six months without missing a payment. These consumers accounted for 73% of the newly scoreable and 91% of the newly scoreable population with scores over 620. Most of the remaining newly scoreable consumers were young or relatively new to the credit journey.

Allowing VantageScore 4.0 into the mortgage marketplace closes the homeownership gap by scoring more creditworthy people, allowing them to qualify for a mortgage.

How will prospective homebuyers benefit from the use of VantageScore 4.0 credit scores in mortgage lending?

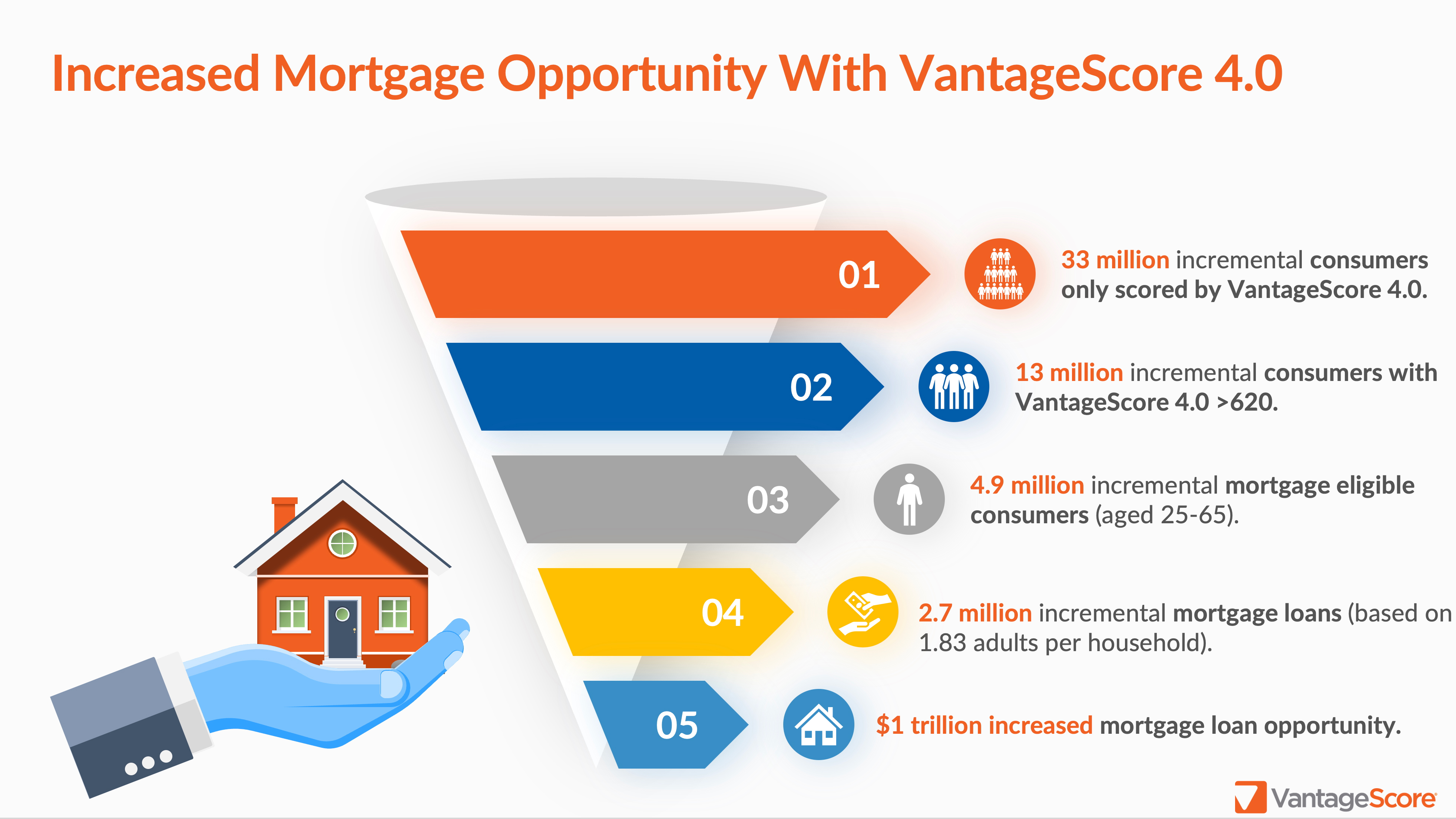

VantageScore research estimates that out of the 33 million consumers who are scoreable with VantageScore 4.0 but unscored by traditional models, 13 million have a credit score of 620, and 4.9 million are mortgage eligible.

From this pool, an estimated 2.7 million new mortgages are possible with VantageScore 4.0, yielding up to $1 trillion in increased mortgage loan opportunities.

What are people saying about VantageScore’s entry into the mortgage market?

Below is a sampling of positive news coverage around this change, highlighting the significant advantages of VantageScore implementation for creditworthy consumers who wish to own a home.

More data reduces risk for the mortgage system. Major banks have concluded that VantageScore 4.0 is more predictive of consumer credit delinquency than FICO Classic. An independent analysis from the Urban Institute found that including rent reporting in credit-score calculation helps more Americans access mortgages.

The time for competition in mortgage credit scoring has come.

– The Wall Street Journal: More Data Means Less Mortgage Risk

VantageScore’s 4.0 model is more inclusive than the “classic” FICO score model, in part because it incorporates alternative sources of data beyond loans, such as rent, utility, and cellphone payments. Recent research has suggested that reporting on-time rent payments to credit bureaus can help establish scores for consumers who lack them and can help raise low scores.

– The New York Times: Mortgage Lenders Can Use a Second Credit Score. Is That Good for Borrowers?

Experts believe [this] announcement is a welcome development as it would create more movement and activity in the housing industry, which has been contending with a deepening affordability crisis that has been preventing buyers from being able to jump into the market.

– Fox Business: Rent payments could help Americans qualify for a mortgage, FHFA says

Fannie Mae and Freddie Mac will now permit lenders to use VantageScore 4.0, a credit scoring model that could unlock homeownership opportunities for millions. Here’s why: FICO requires at least six months of credit history and recent activity to generate a score. If you don’t have both, you’re invisible to lenders. VantageScore is more flexible. It can generate a score with as little as one account-whether that’s a credit card, a collection, or even a bankruptcy-and doesn’t require six months of history or recent activity. That makes it a game-changer for first-time buyers, especially younger adults or people who mostly pay in cash.

– Forbes: Homeownership Just Got Easier For Millions With Limited Credit History—Here’s Why

By opening up the VantageScore credit rating to qualify for a mortgage, more Americans will likely be able to be approved and subsequently purchase homes than before.

– Newsweek: What to Know About VantageScore: New Credit Rating For Mortgages

Fannie Mae and Freddie Mac, the two government-backed companies that support about 70% of the US mortgage market, will allow lenders to use VantageScore 4.0… The move is designed to end FICO’s near-monopoly on credit scoring in mortgage underwriting, lower closing costs, and expand credit to borrowers whose payment histories aren’t well captured by FICO.

– Yahoo! Finance: New credit scoring model for mortgages could help more people buy homes