A ‘check engine’ light went off recently for consumer lenders, according to The Wall Street Journal Writer Telis Demos.

“Late-payment trends have worsened since the spring across consumer lending. In July, a key measure of overdue consumer credit jumped, according to CreditGauge, which is produced by VantageScore.

Consumer-credit payments that were about one to two months past due surged to 0.97% of outstanding balances in July—up from 0.85% in June, and 0.82% a year earlier.”

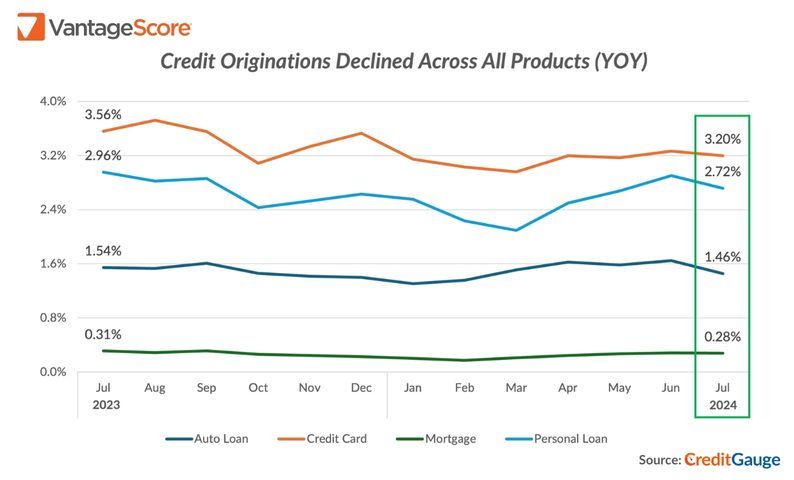

The article also notes that access to consumer credit has tightened in recent months. Borrowers who are feeling pinched may be prioritizing some debt payments, like credit cards, over others, like auto loans, as they try to stay afloat in a tough economic cycle.

“Even in a soft landing, things could still get harder for many borrowers and their lenders,” the article adds.

CreditGauge is VantageScore’s monthly analysis of U.S. consumer credit health. Read the latest insights here: https://www.vantagescore.com/lenders/credit-gauge/

Read more here: https://www.wsj.com/livecoverage/cpi-report-today-august-2024-inflation-09-11-2024/card/why-ally-s-warning-light-on-credit-should-be-heeded-faRNWNf7xguipwRgegLx