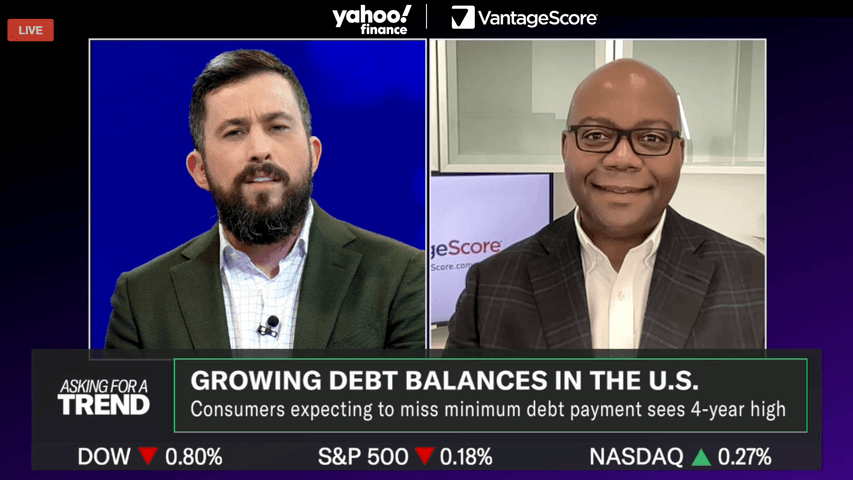

VantageScore President and CEO Silvio Tavares joined Yahoo! Finance to discuss the latest insights from VantageScore’s September 2024 CreditGauge.

_“_The consumer looks healthy, but the reality is there’s definitely risk on the horizon,” said Tavares. “Both banks see it and consumers see it. According to VantageScore CreditGauge, banks actually throttled back on new credit accounts in September across every major loan category. Consumers see risk as well on the horizon — they’re cutting back. If you compare credit card balances to August, in September they decreased slightly.

Tavares continued to explain the factors impacting a bifurcated economic recovery – some consumers are performing well, while others are still struggling. “Overall, you see the average consumer remaining pretty healthy through September, mostly driven by those older consumers: those born after 1965, what we call ‘X.’ On the other hand, younger, less affluent consumers are struggling. In September 2024, we saw delinquencies across all credit products increasing for those younger, less affluent consumers.”

What’s driving a lot of that difference in experience is whether you’re a homeowner or not.

If you’re older, you own your own home. You’ve got a cushion there, so you’re not exposed to inflationary pressures. Younger folks are not homeowners typically, and they are struggling with the increased interest rates and the very high rate of inflation that we’ve seen over the last 24 months.

The September 2024 VantageScore CreditGauge shows that credit card delinquencies are spiking, which could reflect nervousness among consumers heading into the end of the year.

If you look at the data for the most recent period in September, credit cards in particular are flashing a lot of warning signs. Delinquencies were up across all products. Across every vintage of loans and age of delinquencies, everything is flashing red.

I think consumers do want to spend more, but the reality is they’re uncertain about how the election is going to play out. Depending on how that election plays out, especially the presidential election, that’s going to have an impact on consumers’ willingness to spend more. So the bottom line is it’s uncertain: that’s how consumers see it, and that’s how banks see it.

CreditGauge is VantageScore’s monthly analysis of U.S. consumer credit health. Catch up on the latest CreditGauge insights here: https://www.vantagescore.com/lenders/credit-gauge/.

Watch Silvio’s interview here: