“We were expecting consumers in March to have deteriorating credit quality when, in fact, the opposite was true.”

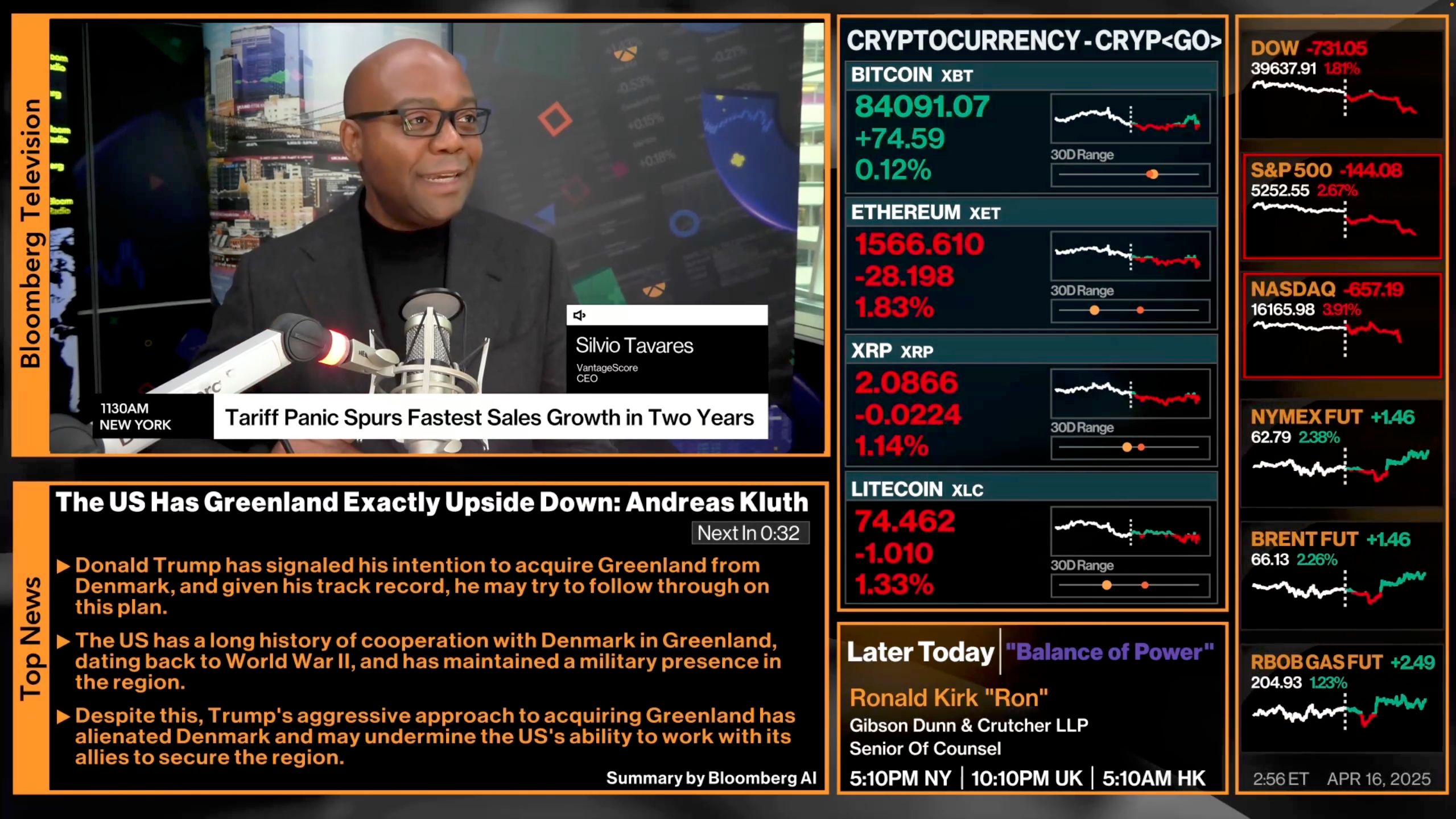

VantageScore President and CEO Silvio Tavares spoke with Yahoo! Finance to share the latest insights on consumer credit health from VantageScore’s March 2025 CreditGauge analysis.

If you look at auto loans, credit cards, personal loans, and mortgages, across every single one of those credit products, credit delinquencies actually declined compared to February. So, consumers are doing everything they can to get their personal balance sheet in order. They are credit healthy, and they want to maintain that credit health because they are concerned about what happens next.

Additionally, Tavares commented on the increasing stress shown by higher-income consumers in this economic environment:

Traditionally, in a weakening or decelerating economy, it is the lower-income consumers that are the most vulnerable. One of the counterintuitive trends we’ve seen over the last several years is that if you look at the high-income consumer, they have been having a very significant increase in delinquencies,” added Tavares. From January 2023 to March 2025, credit delinquencies have increased by 103% for high-income consumers, or those VantageScore defines as making over $150,000 per year.

See more of VantageScore’s latest CreditGauge insights and analyses here: https://www.vantagescore.com/insights/creditgauge.