Consumers have started spending more cautiously – a shift likely to have implications for lenders, as reported in the Wall Street Journal’s “Heard on the Street” column.

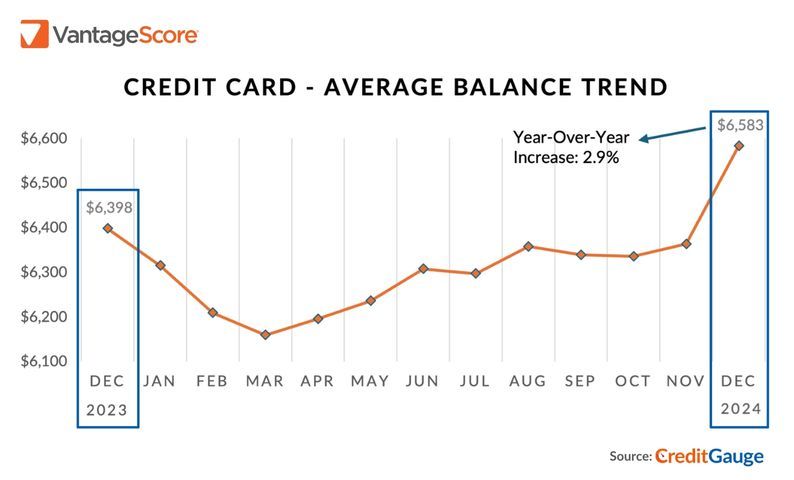

VantageScore’s December 2024 CreditGauge showed average credit-card balances grew 2.9% in December from the same month a year prior, which was roughly in-line with the annualized rate of inflation.

This indicates cautious credit usage by consumers looking to plug the hole in their wallets left by inflation,” noted VantageScore.

This isn’t necessarily a good sign for lenders. For them, higher delinquencies can even be offset if there is tons of spending and borrowing going on. Instead, if loan growth stays muted, banks will see pressure on their revenue even if people pay their debts.

CreditGauge is VantageScore’s monthly report on U.S. consumer credit health. Read the latest CreditGauge insights here: https://www.vantagescore.com/lenders/credit-gauge/

Read more here: https://www.wsj.com/livecoverage/stock-market-today-dow-sp500-nasdaq-live-01-28-2025/card/selective-and-cautious-consumer-is-a-problem-for-card-lenders-G0hmFPsNaIEnwOT0DjlQ