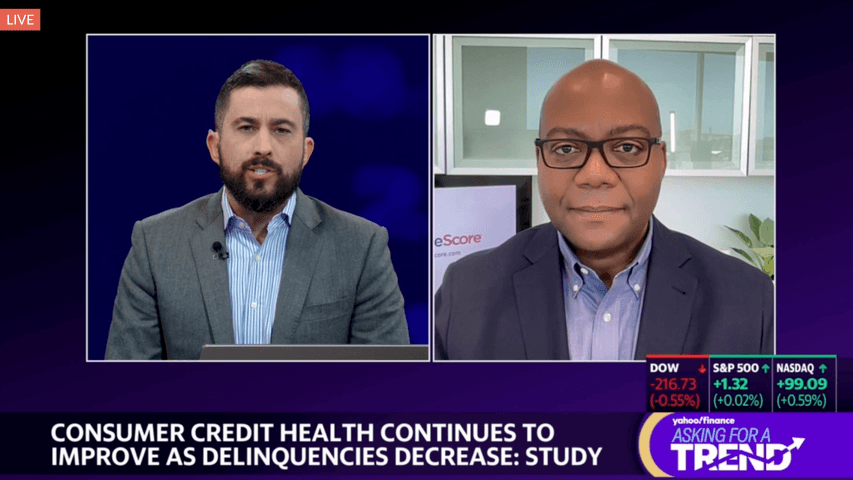

The good news is the consumer is very healthy and improving in overall credit health. As you look at the end of April, the average VantageScore is 702… and 702 is a great credit score. Banks are also increasing their lending. We saw originations of new credit accounts increasing through the end of April, which is all good news and makes it unlikely the Fed is going to cut rates anytime soon.

Silvio Tavares, President and CEO of VantageScore joined Yahoo! Finance to give his perspective on the state of consumer credit health and when U.S. consumers might expect to see the Federal Reserve make a rate cut.

Silvio added, “We’ve actually been very bullish on the consumer for the most part of last year. While others were forecasting the untimely death of consumer spending, that didn’t happen. The data shows that overall, we have a very healthy average consumer, but there are segments showing some weakness. We’re seeing younger, less affluent consumers under stress.

VantageScore’s April 2024 CreditGauge analysis showed the average VantageScore 4.0 credit score held steady at 702, indicating that Americans’ financial health remained strong despite the various economic headwinds placing extra pressure on consumers.

This is the big challenge right now. The Federal Reserve wants banks to be tightening credit and making less loans, and we’re not seeing that. In fact, we’re seeing the opposite of that: banks are actually increasing their lending because consumers have higher average credit scores and are employed for the most part,” concluded Silvio.