New Credit Card and Auto Loan originations are declining after increases over the summer, according to the latest edition of CreditGauge™ by VantageScore. Month-over-month, new credit loans decreased across all credit products as banks appear to pull back on new lending. The average VantageScore 4.0 credit score remained stable at 701 in September.

Banks are reining in new lending, suggesting that banks are taking a more cautious posture after a strong summer and leading to originations softening across most credit products,” said Susan Fahy, EVP and Chief Digital Officer at VantageScore. “Early-stage delinquencies are near levels last seen before the COVID pandemic.

Watch CreditGauge LIVE for additional key insights from the September 2025 edition of CreditGauge that include:

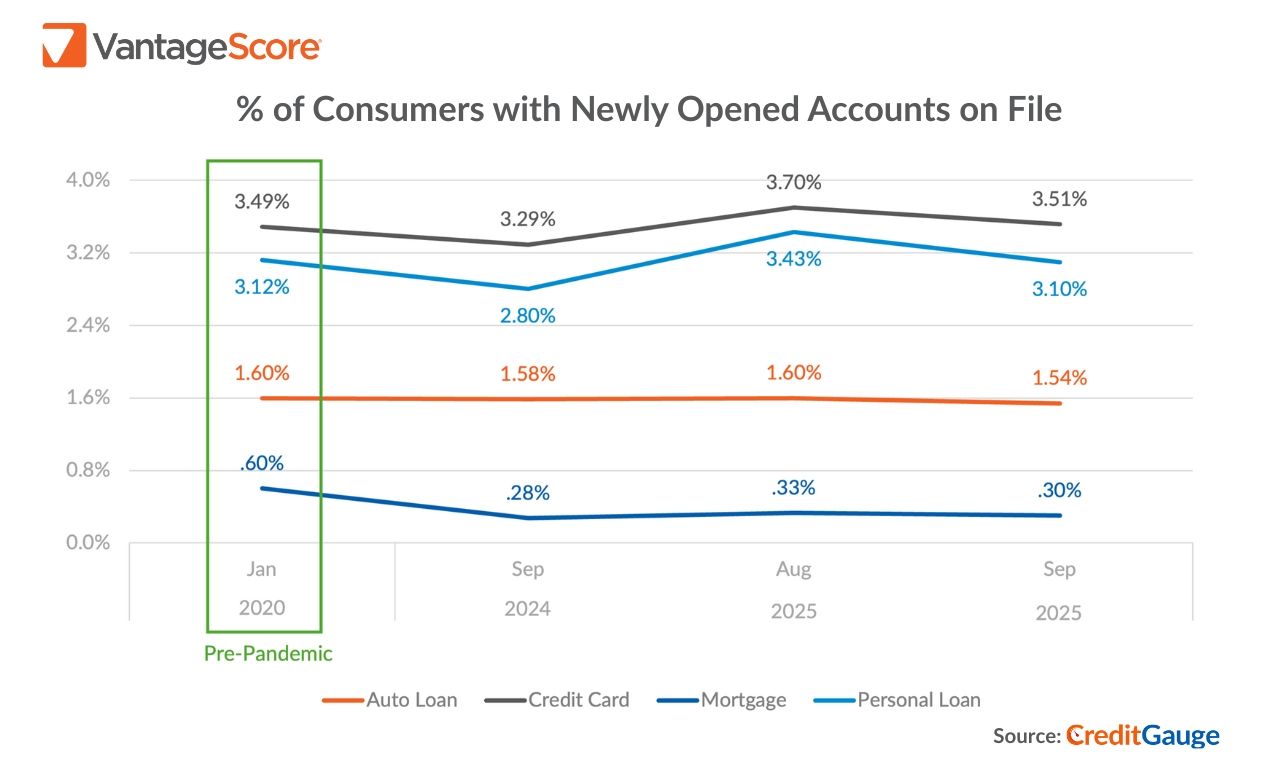

NEW CREDIT COOLS MODESTLY AFTER A STRONG SUMMER: In September 2025, originations declined across all products month-over-month, led by Personal Loans, followed by Credit Cards, Auto Loans and Mortgages. Notably, new Auto Loans and Mortgages have remained relatively subdued since early 2025, likely constrained by high interest rates, affordability and macroeconomic headwinds.

MORTGAGE CREDIT DELINQUENCIES RISE ACROSS ALL DELINQUENCY STAGES: Mortgage credit delinquencies increased month-over-month and year-over-year across all stages of delinquency. The rise was most pronounced in late-stage (90-119 Days Past Due) accounts, reaching the highest level since January 2020 and marking the largest year-over-year relative increase among all credit products.

EARLY-STAGE DELINQUENCIES AT YEAR-TO-DATE HIGH, NEARING PRE-PANDEMIC LEVELS: Overall credit delinquencies edged higher in September, with 30–59 Days Past Due delinquencies rising to 1.13%, up slightly from 1.02% in August. These early-stage delinquencies are approaching the pre-pandemic threshold of 1.15% for the first time in five years.

CreditGauge is a monthly analysis highlighting the overall health of U.S. consumer credit. To download this month’s full CreditGauge report, visit the VantageScore website.

Follow VantageScore on LinkedIn and YouTube to watch CreditGauge LIVE, a monthly video series featuring our latest insights on consumer credit data and analysis.