Auto Loan delinquencies have now evolved from being one of the least risky consumer credit products to one of the loan types most prone to delinquencies, according to a new analysis published today by VantageScore. An increased number of consumers are struggling with monthly Auto Loan payments, which have risen due to rising car prices, higher financing costs, and increased interest rates. These factors are compounded by rapidly escalating auto insurance and repair costs, reducing consumer visibility into monthly payments and exacerbating delinquencies. Further complicating delinquency patterns, a historically high number of consumers owe more on their car loans than their car’s market value.

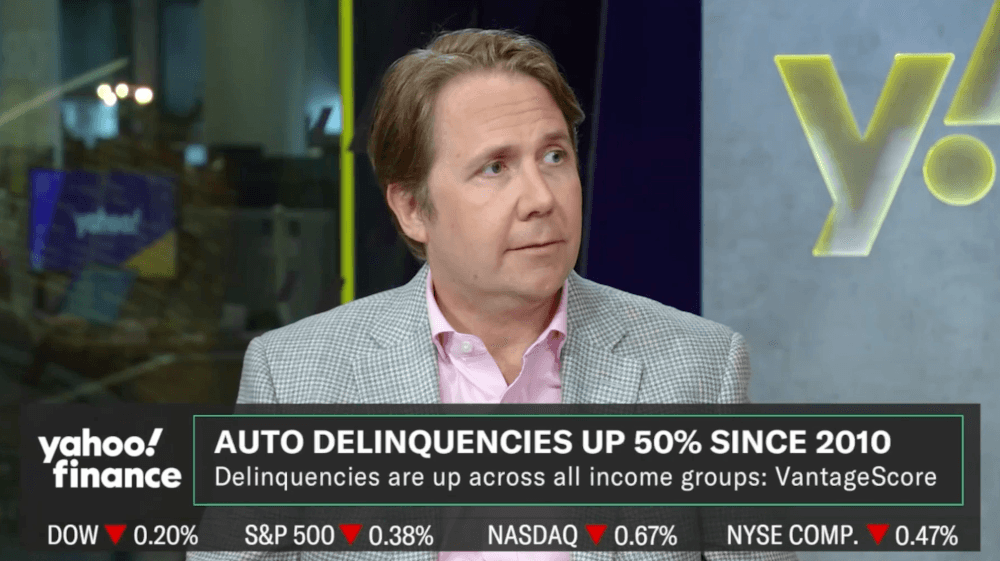

Auto loans have not followed the trends of other credit products as delinquencies have been persistently trending up across all credit tiers and income groups over the past 15 years,” said Dr. Rikard Bandebo, Chief Strategy Officer and Chief Economist at VantageScore. “Even after the industry tightened lending criteria three years ago, delinquencies have continued to rise.

VantageScore’s research found that the increase in delinquencies is not attributable to any specific group of consumers, as delinquencies were higher across credit risk tiers and income groups. While many lenders adjusted their criteria in response to growing losses in 2022 and 2023, delinquencies have continued to rise rather than decline.

Key conclusions from the VantageScore study include:

AUTO LOANS ARE NOW ONE OF THE RISKIEST COMMERCIAL CREDIT PRODUCTS: While all other credit products have seen delinquencies decline since 2010, Auto Loan delinquencies have risen by over 50%. In the aftermath of the Great Recession, Auto Loans were the least risky credit product in 2010. In 2025, they have earned the title of being one of the riskiest. Only student loans are riskier. Auto Loan delinquencies are growing across credit tiers and income groups.

AFFORDABILITY IS A KEY DRIVER OF LOSSES: The average Auto Loan balance has grown 57% since 2010, outpacing all other credit products. Additionally, the analysis shows that increased balances on Personal Loans are highly correlated with Auto Loan delinquencies. This is another sign that consumers are struggling to and potentially falling into a debt spiral as they rely on loans to help them cover their cashflow shortfall, as their monthly expenses have outpaced their income.

ADJUSTMENTS TO LENDING CRITERIA HAVE NOT LOWERED DELINQUENCIES: Many lenders changed their standards in response to increasing losses in 2022 and 2023, yet delinquencies have not decreased but continued to climb. The changes have reduced delinquencies among VantageScore Subprime borrowers, but losses in Near Prime and Prime have climbed rapidly, more than offsetting the impact on Subprime loss reductions.

VantageScore credit scores are expanding usage in the capital markets, serving as a trusted benchmark in asset-backed securitizations and delivering investors enhanced transparency and predictive performance. To learn more, visit vantagescore.com/what-we-do/capital-markets.