Let us know who you are

Why VantageScore?

Predictive Performance

Performance highlights include a 5.7% predictive improvement for newly issued mortgages, 4.5% predictive improvement for newly issued personal installment loans and 3.8% predictive improvement for existing auto loans.

Founded to Innovate

VantageScore was the first credit scoring model to:

- Incorporate rent payment data when present in the consumer credit file

- Provide consumer-friendly explanation of adverse responses to credit inquiries

- Eliminate paid collections and all medical collections

- Provide end users with transparency on the inputs that generate the VantageScore credit score

- Empower consumers to share a more complete view of their financial picture with consumer-permissioned data

- Provide commercially-available credit scores for free to consumers

Commitment to Financial Inclusion

VantageScore in the Mortgage Market

In 2018, Congress enacted the Credit Score Competition Act. This authorized the Federal Housing Finance Agency (FHFA) to rectify the credit score monopoly in the mortgage market by reviewing and implementing newer, more predictive credit scores for use in mortgages.

As a result, VantageScore 4.0 was mandated for use in mortgages by FHFA starting Q4 2025 for its superior predictive power and inclusion of more consumers. VantageScore estimates the use of VantageScore 4.0 will add up to 2.7 million new mortgages, or $1 trillion, to the mortgage market.

Score More Consumers

VantageScore’s 4.0 model yields an incremental predictive performance life among dormant credit consumers, as well as consumers with limited credit histories. With this technology approximately, 33 million more consumers are able to be scored than previously.

Predictive Lift Across Industries

Our newest model outperforms previous models in every major credit category, with significant overall predictive lift and a 5.3% predictive lift in mortgage origination.

More Consistent Scoring

With our patented uniform model characteristics, VantageScore scores are more consistent among the three three nationwide consumer reporting agencies, so lenders can be more confident in the validity of the scores.

Yearly Performance Assessments

Our analytics team runs yearly performance tests to ensure the VantageScore model continues to deliver highly predictive and consistent credit scores.

Refreshed Data Set

VantageScore models are continually re-developed using refreshed data to reflect the latest credit products and most recent trends in consumer behavior.

Greater Stability

VantageScore utilizes an exceptionally wide breadth of consumer credit data that allows the model to retain its predictive power even during times of economic volatility.

Approximately 33 million more Americans can be scored by our models.

21% of millennials have "thin files," making it difficult for lenders to see them as strong borrowers and leading to more young consumers not able to get the credit they need.

Demographic Breakdown

Breakdown of Newly Scorable Consumers

VantageScore credit scores are used every day

3700 +

Banks, fintechs and other companies use VantageScore credit scores every day to assess consumer creditworthiness.

VantageScore is the fastest growing credit scoring company in the U.S., developing the industry's most innovative, predictive, and inclusive credit score models. More than 3,700 institutions use VantageScore credit scores to provide consumer credit products like credit cards, auto loans, personal loans and mortgages.

Starting in 2025, the FHFA has required VantageScore credit scores to be used for all mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. Get started using VantageScore credit scores today - the leader in predictive power and financial inclusion.

42 Billion

VantageScore credit scores used in 2024

55%

yearly increase in 2024 VantageScore usage

$13.4 Billion

in ABS issuances using VantageScore in 2024

All top 10

banks use VantageScore credit-scores or digital tools in one or more lines of business

220 Million

Consumers have free access to their VantageScore credit scores

Industries We Serve

Explore How VantageScore Can Transform Your Lending Decisions

Mortgage

Auto

Credit Card

Credit Unions

Capital Markets

Policy Makers

Digital Tools

VantageScore 4.0

Machine Learning Technology + Trended Credit Data = Score 33 Million More U.S. Consumers

VantageScore 4plus™

All the Benefits of VantageScore 4.0 + Bank Data = Over 10% Predictive Lift

VantageScore 5.0

Innovative and Proprietary GAIN Attributes™ Generate Insights Beyond Traditional Scoring Inputs

Quantifying the Relationship between VantageScore Credit Scores and the Relative Risk of Default

Mortgage Industry News Regulations Trends

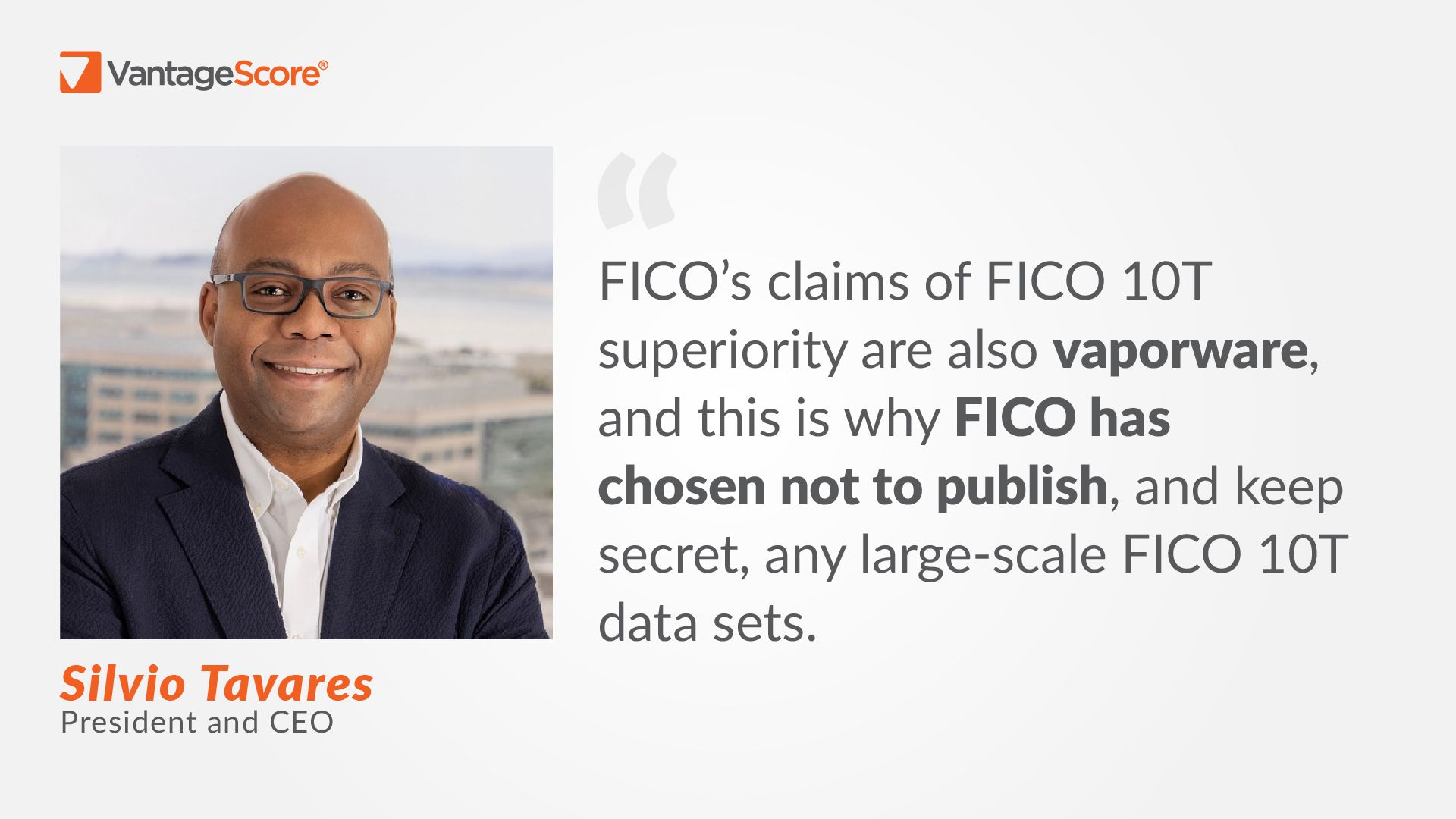

March 5, 2026FICO’s Secret Vaporware: 10T Is Not Better Than VantageScore 4.0

Creditgauge Report

February 26, 2026Early-Stage Credit Delinquencies Increase Across All VantageScore Credit Tiers: January 2026 CreditGauge™