Let us know who you are

Credit is key to functioning in the modern world, but what is it and what does it mean? If you have these questions, you are in good company. Below, we break it down to help you better understand the credit landscape.

Understanding Credit

What is Credit?

Credit is your ability to borrow money or enter into agreements based on an understanding that you'll pay the money or obligation back later.

What is a Credit Report?

Your credit report is all of the credit-related data a Nationwide Consumer Reporting Agency (NCRA) has gathered about you from different sources.

What is a Credit Score?

Your credit score is used to assess your likelihood of defaulting on payments you owe (i.e., going 90 days or more without paying a debt obligation).

See Your Score Changing?

Score changes often indicate a highly stable and consistent score. Any change to a balance, credit limit, and even the passage of time could result in score variation.

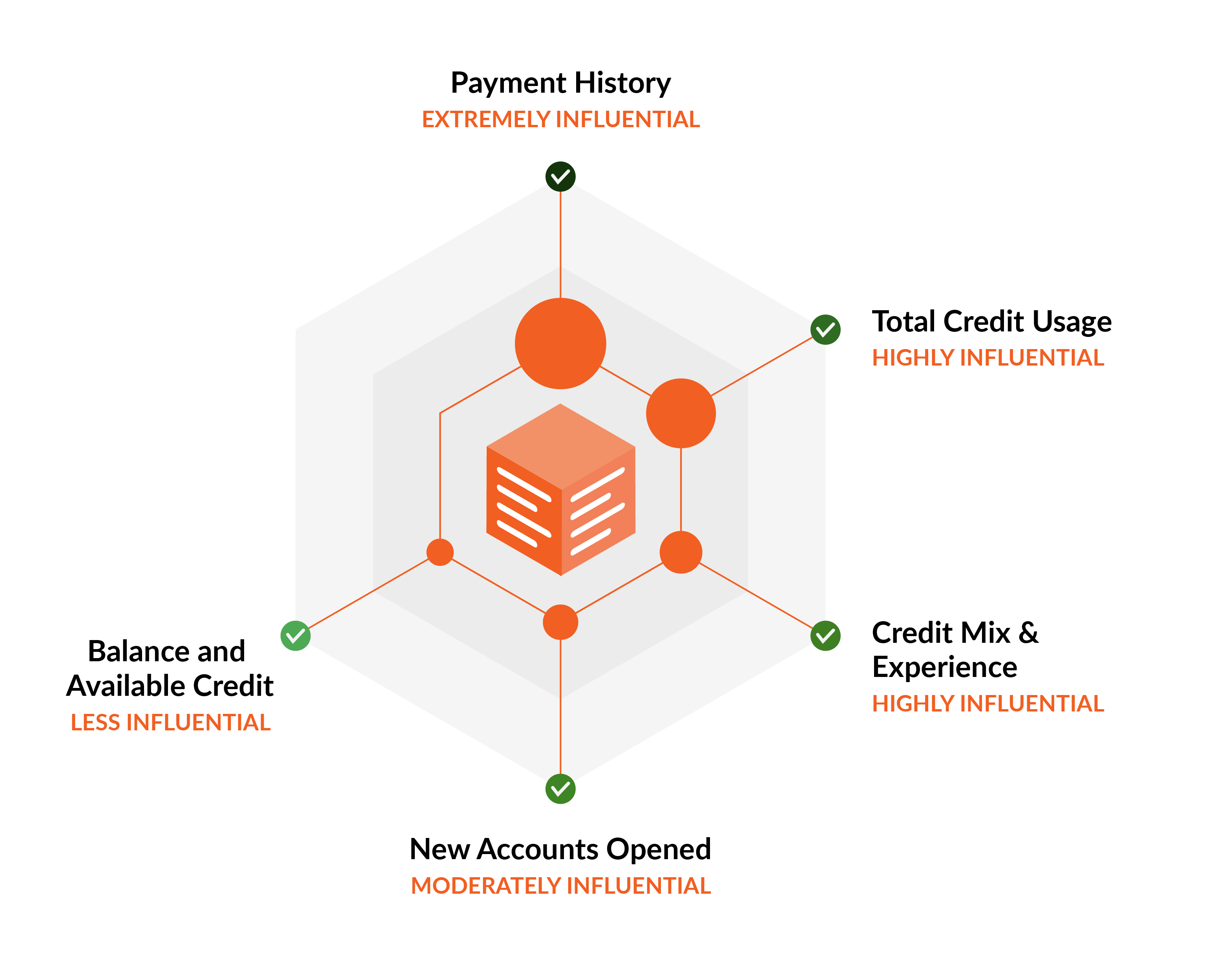

What Influences My Credit Score?

Not all factors are created equal when it comes to your credit score. Some, such as payment history, are influential, while others are less important, like new accounts opened. While everyone’s credit profile is different, there are similarities in what lenders look for in a borrower's history to make their lending decisions, listed below. Learn how credit scores are determined. Each is ranked from most important to least.

Payment History Extremely Influential

Payment history is important to lenders. If you’ve missed even one payment, your credit score suffers, making it more difficult to open additional credit accounts or access additional funds through the accounts you already have. Do everything you can to stay current.

Total Credit Usage Highly Influential

Experts advise that to have credit scores considered “good” or “excellent,” you should use 30% or less of the total credit available to you. For example, if you have a credit card with a $1,000 limit, it’s best to not carry a balance on that card of more than $300.

Credit Mix & Experience Highly Influential

A credit mix that’s varied, such as a car loan, a credit card, and a mortgage, demonstrates to lenders that you’re able to responsibly manage different types of credit responsibly over time. Take steps to increase the types of credit you access. Also, the longer you’ve had a credit account, the better—which is why it’s important to establish credit early in adulthood if possible.

New Accounts Opened Moderately Influential

Too many new accounts opened in a short amount of time can result in denial of credit. To protect and grow your credit score, it’s best to space out your applications for credit cards and other credit accounts.

Balance & Available Credit Less Influential

Paying down credit balances and having a high amount of credit available demonstrates that you have financial flexibility. Whenever possible, pay down balances on your accounts.

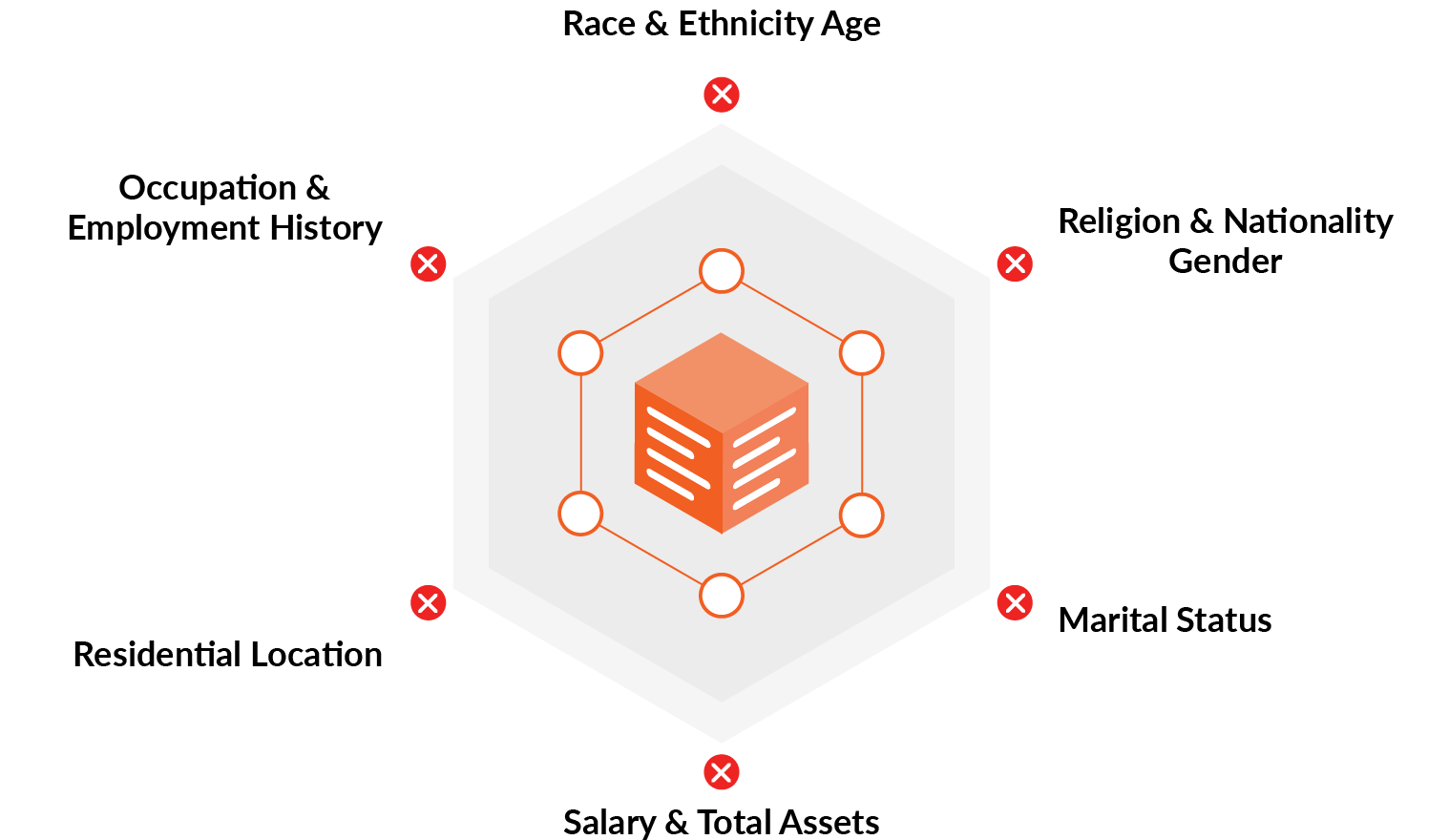

What Does Not Count?

We do not include race, color, religion, nationality, gender, marital status, age, salary, occupation, employer, employment history, where you live, or even your total assets, when determining your credit score.

Your credit score is utilized by various entities to assess your creditworthiness and financial reliability

Lenders

Lenders of all types pull credit scores to help them assess the likelihood that you will fall behind on the payment of a loan.

Landlords

When determining your ability to pay rent on an apartment and how much a security deposit will be required to sign the lease.

Mobile Phone Companies

When determining payment plans you are eligible for and whether or not a security deposit will be required.

Utility Companies

When determining whether or not to require a security deposit, and if so, how much of a deposit to require.