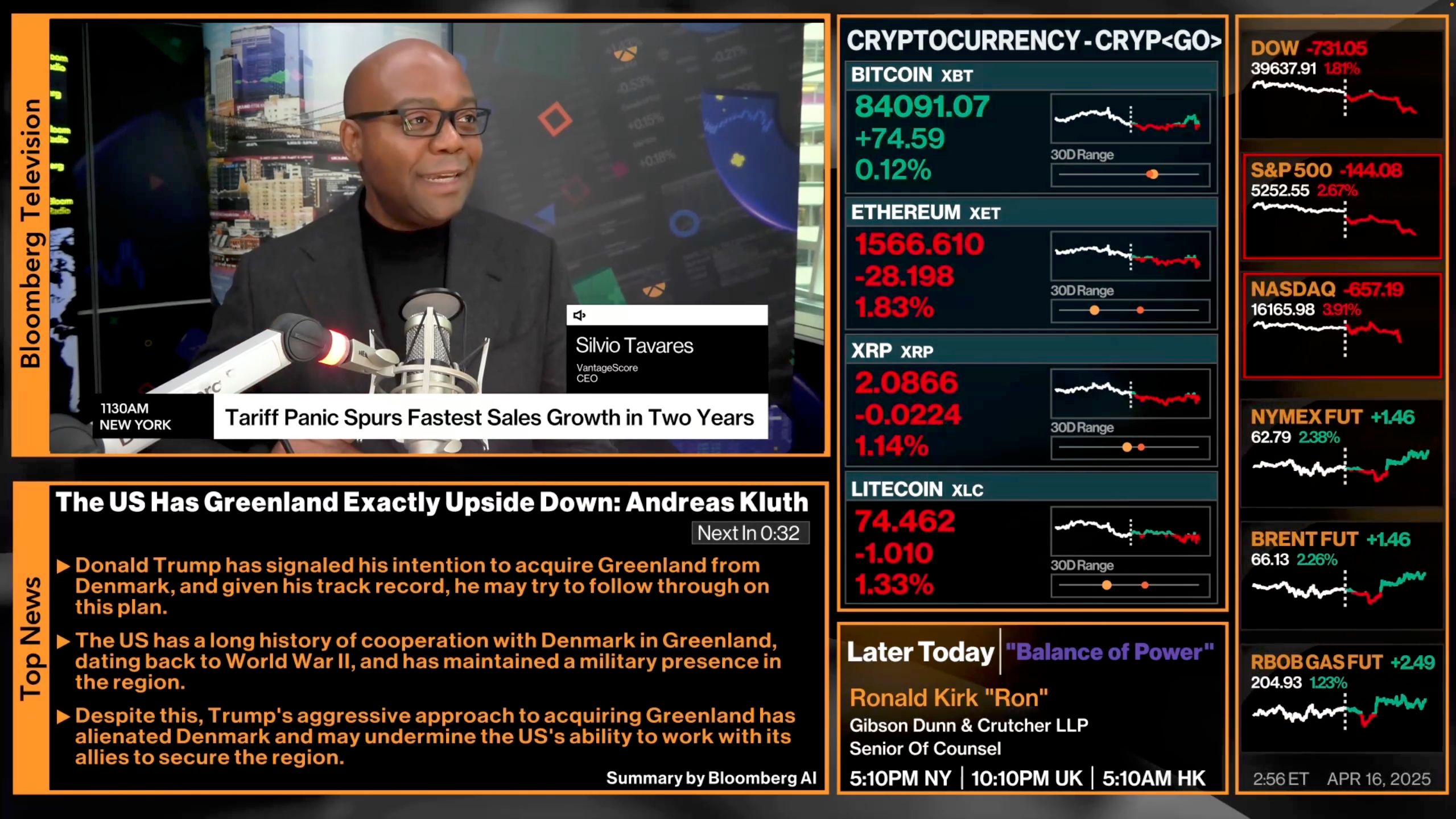

VantageScore has expanded its VantageScore 4plus pilot program for lenders, as highlighted in a recent Open Banking Expo article. In partnership with national non-profit network Credit Builders Alliance, the VantageScore 4plus model enables access to open banking data to help underserved borrowers get access to credit.

Initial data from the pilot, which started in September 2024, has shown improvements in the ways non-profit lenders can assess and serve potential borrowers. Applicants with new-to-credit, thin or inactive credit files comprised 15% of the participants in the pilot program and were found to have benefited “significantly” from the addition of open banking data.

Nonprofit lenders need tools that are both inclusive and predictive,” said Andrada Pacheco, EVP and Chief Data Scientist at VantageScore. “This initiative validates the idea that when enhancing credit file with cash flow data, lenders can expand credit access responsibly without incurring additional losses.

Key insights from the program include improved predictive life, clearer risk segmentation, and expanded decisioning opportunities.

Catch up on VantageScore’s recent model announcements here:

https://www.openbankingexpo.com/news/vantagescore-expands-open-banking-credit-score-pilot/